Q1 2016 witnessed the great changes in policy, price and import & export of corn in China's market.

- Policy

In 2016, the Chinese government issues some policies and measures for the corn

industry.

23 April: The Ministry of Agriculture of

the People's Republic of China (MOA) issued the China Agricultural Outlook

Report (2016-2020), making a prediction on indexes of China's corn industry

including planting area in the coming 10 years. China planned to reduce the

planting area and yield of corn while increasing the consumption and export.

11 April: The MOA issued the Adjustment

Plan on the National Crop Farming (2016-2020), planning to reduce corn planting

areas and develop other corn varieties such as silage corn.

28 March: The National Development and

Reform Commission, together with some departments, announced to cancel the

purchase policy of corn for temporary storage in Jilin, Heilongjiang and Liaoning

provinces as well as the Inner Mongolia Autonomous Region and then adjust to a

new mechanism – "market-oriented purchase + subsidy". Meantime, China

will set the subsidy policy and minimum purchase price for corn.

Feb.: The State Administration of Grain

(SAG) issued a letter to collect the list of processing enterprises that are

going to participate in the directional selling of overstored grains, which

officially opened the gate for the directional selling of corn.

Early in Nov. 2015, the MOA issued the Structure Adjustment Plan on Corn

Planting Area in Sickle-shape Region (2016-2020), hoping to slow down the

irrational increase in corn supply by reducing corn planting area. The planting

area is expected to be cut down by over 3.33 million ha (50 million mu) in the

sickle-shape region by 2020.

Notably, the purchase volume of corn for temporary storage hits a record high

in 2015/16, being 125.42 million tonnes as of 30 April, 2016.

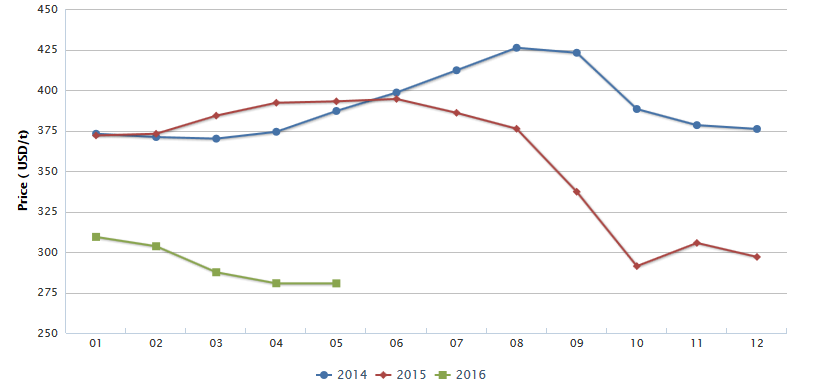

- Price

Affected by the high-level domestic corn inventory, China's market price of

corn has kept falling since H2 2015. The average figure dropped to USD300.14/t

in Q1 2016, down by 20.26% YoY. Average market prices in Jan.-March were:

Jan.: USD309.34/t, a YoY fall of 16.84% and

a MoM rise of 4.10%

Feb.: USD303.56/t, a YoY fall of 18.61% and

a MoM fall of 1.86%

March: USD287.53/t, a YoY fall of 25.15%

and a MoM fall of 5.20%

At the same time, the falling corn price caused declines in average prices of

some downstream products in Q1 2016:

Corn starch (North China): ex-works price

at USD360.92/t, down by 24.58% YoY and 9.42% MoM

Furfural: market price at USD1,047.41/t,

down by 23.61% YoY and 11.41% MoM

Market price of corn in China, Jan. 2014-May 2016

Source: CCM

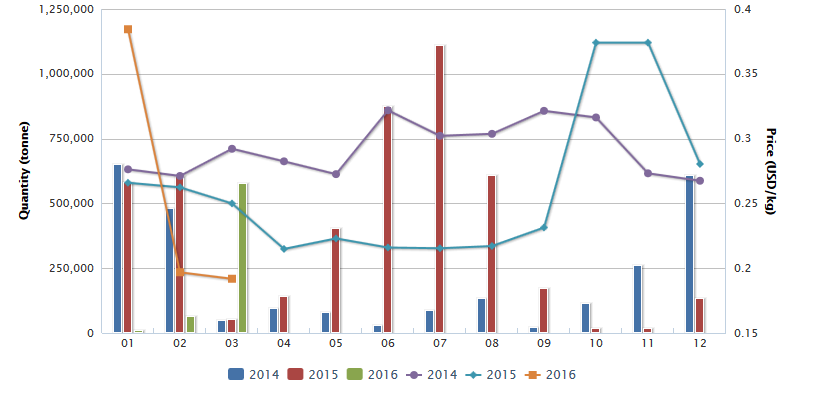

- Import & export

Q1 2016 saw abnormal import & export of corn in China. Although the market

price kept falling in China, it was still higher than the import price, which

led to weakening price advantage in the international market. Therefore, China

import more corn but export less in Q1.

Generally speaking, the first quarter

of a year is the busy season for corn import in China and then the import

volume will fall back in the second quarter. However, the import volume in

Jan.-Feb. 2016 was only a tenth of that in Jan.-Feb. 2015, while the figure

rebounded in March – a YoY rise of 1,037.82% and a MoM rise of 823.78%.

According to China Custom, China imported 645,500 tonnes of corn in Q1 2016,

down by 47.64% YoY. Notably, the import volume will maintain a low level, due

to China's reduction in corn inventory in later period, continuously falling

domestic corn price, and narrowing gap between domestic market price and import

price.

Imports of corn in China, Jan. 2014-March 2016

Source: China Customs

According to CCM's price monitoring, China's market price of corn is

USD280.59/t in May 2016. Although the price still maintains a low level, it has

shown a slight rebound, mainly because of the tight supply of corn in the

market now – most of corn in the market has been stored by the state and the

surplus high-quality one has been basically consumed.

On 13 May, the SAG

conducted an auction for the directional selling of corn (400,000 tonnes,

harvested in 2012) only for alcohol and feed enterprises, which indicates an

official start for the directional selling of overstored grains this year.

Recently, all provinces will announce the lists of enterprises that participate

in the directional selling in succession.

As the SAG announced to hold auction

fairs for overstored corn and corn stored outdoors in the SAG and national

grain trading centers of all provinces (districts and cities) each week since

27 May, 2016, it is predicted that a large quantity of overstored corn will be

sold in later period.

Coupled with that many provinces have made auctions for

corn, the policy-oriented grains will dominate the market. Boosted by the low

auction price, the domestic market price of corn will reduce to some extent at

that time. CCM will make follow-up reports on the auctions.

This article comes from Corn Products China News 1605, CCM

About CCM:

CCM is the

leading market intelligence provider for China’s agriculture, chemicals, food

& ingredients and life science markets. Founded in 2001, CCM offers a

range of data and content solutions, from price and trade data to industry

newsletters and customized market research reports. Our clients include Monsanto,

DuPont, Shell, Bayer, and Syngenta. CCM is a brand of Kcomber Inc.

For more information about CCM, please visit www.cnchemicals.com or get in touch with us

directly by emailing econtact@cnchemicals.com or calling

+86-20-37616606.

Tag: corn